Core Numbers

- ₦800,000 — PIT exemption threshold for low-income earners.

- ≤ ₦100m — SME turnover often referenced for CIT relief.

- 7.5% — VAT rate unchanged; more items VAT-exempt.

- CRA removed — rent and approved contributions highlighted instead.

Progressive PIT, targeted reliefs, SME incentives and VAT exemptions — explained in plain language for salary earners and business owners.

TheMainCEOs • RC-1671809 • Educational guide only — for personalised advice, chat with us on WhatsApp.

A practical overview for salary earners and business owners — not just tax experts.

Use this to understand where you roughly fall before reliefs/deductions.

| Annual Income Band (₦) | Rate |

|---|---|

| ₦0 – ₦800,000 | 0% |

| ₦800,001 – ₦3,000,000 | 15% |

| ₦3,000,001 – ₦12,000,000 | 18% |

| ₦12,000,001 – ₦25,000,000 | 21% |

| ₦25,000,001 – ₦50,000,000 | 23% |

| Over ₦50,000,000 | 25% |

CRA (Consolidated Relief Allowance) is abolished and replaced with targeted reliefs like rent relief (lower of ₦500,000 or 20% of annual rent), plus deductions for pension, NHF, NHIS and similar approved contributions (as shared).

Enter your yearly income to see a rough band-based estimate before any reliefs.

This is a rough band-only estimate. Actual tax payable may be lower after applying reliefs/deductions and official computation formulas. Always confirm with an authorised tax adviser.

Why your structure (Enterprise vs LTD) matters more under the new regime.

To align with company-level incentives, a Limited Liability Company (LTD) is usually stronger than a bare Business Name.

The same hustle can feel very different on paper — and in how tax and risk apply.

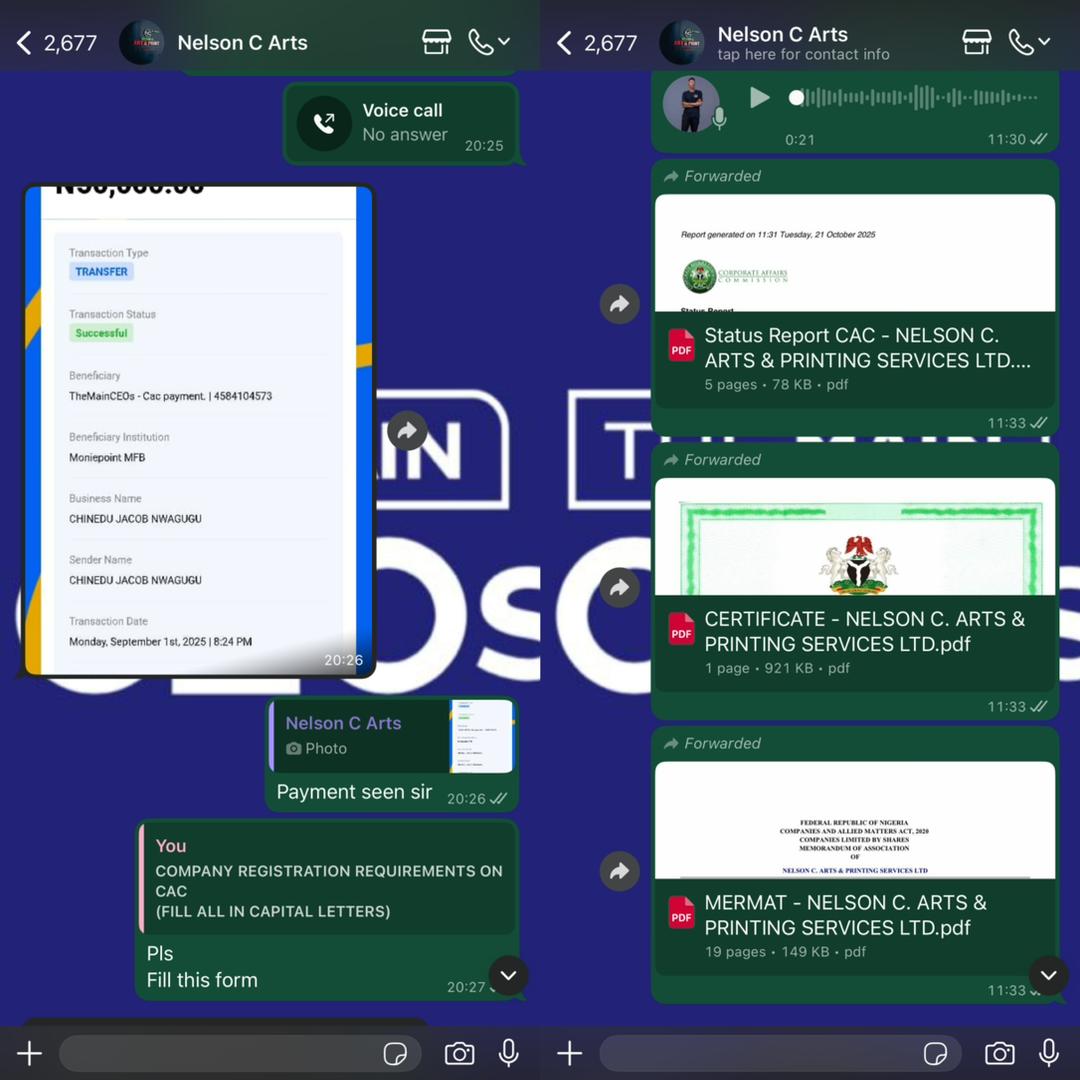

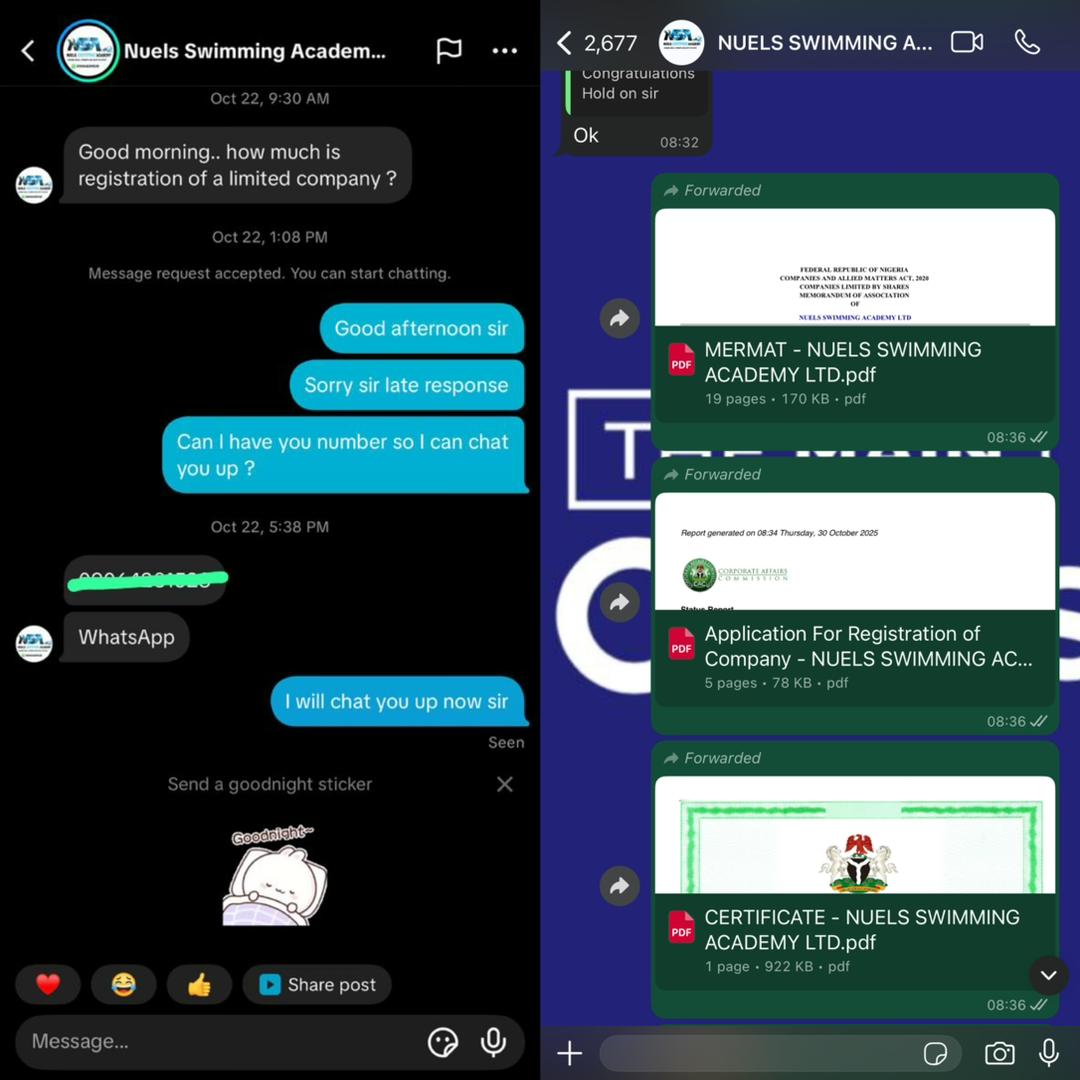

You can start as an Enterprise and later upgrade to LTD when you’re ready — TheMainCEOs can handle both.

The VAT rate stays the same, but more day-to-day essentials are VAT-free (as shared).

TheMainCEOs can help structure your invoicing and basic record-keeping so you can separate VAT, income and expenses cleanly.

Use this as a starting point — then talk to us to implement properly.

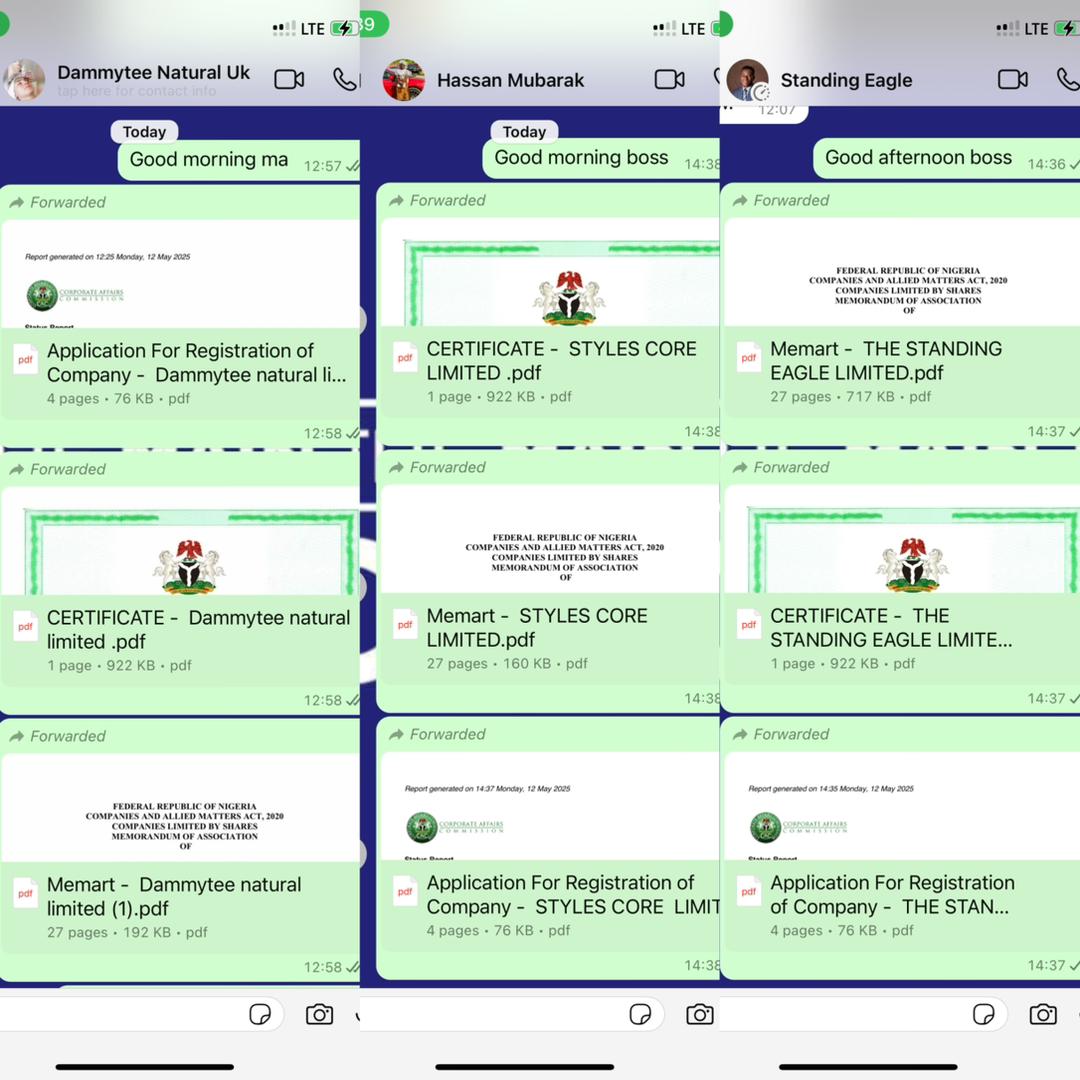

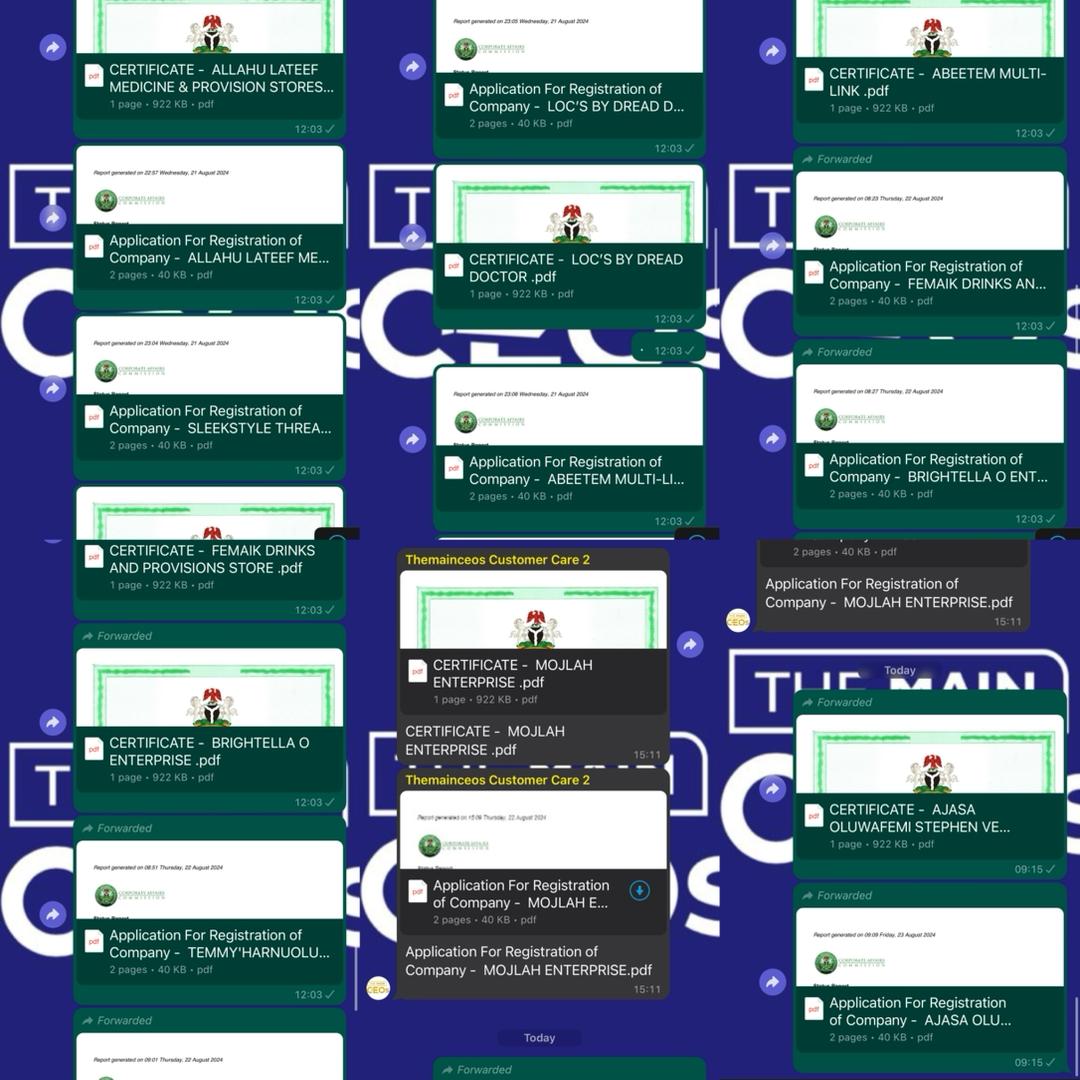

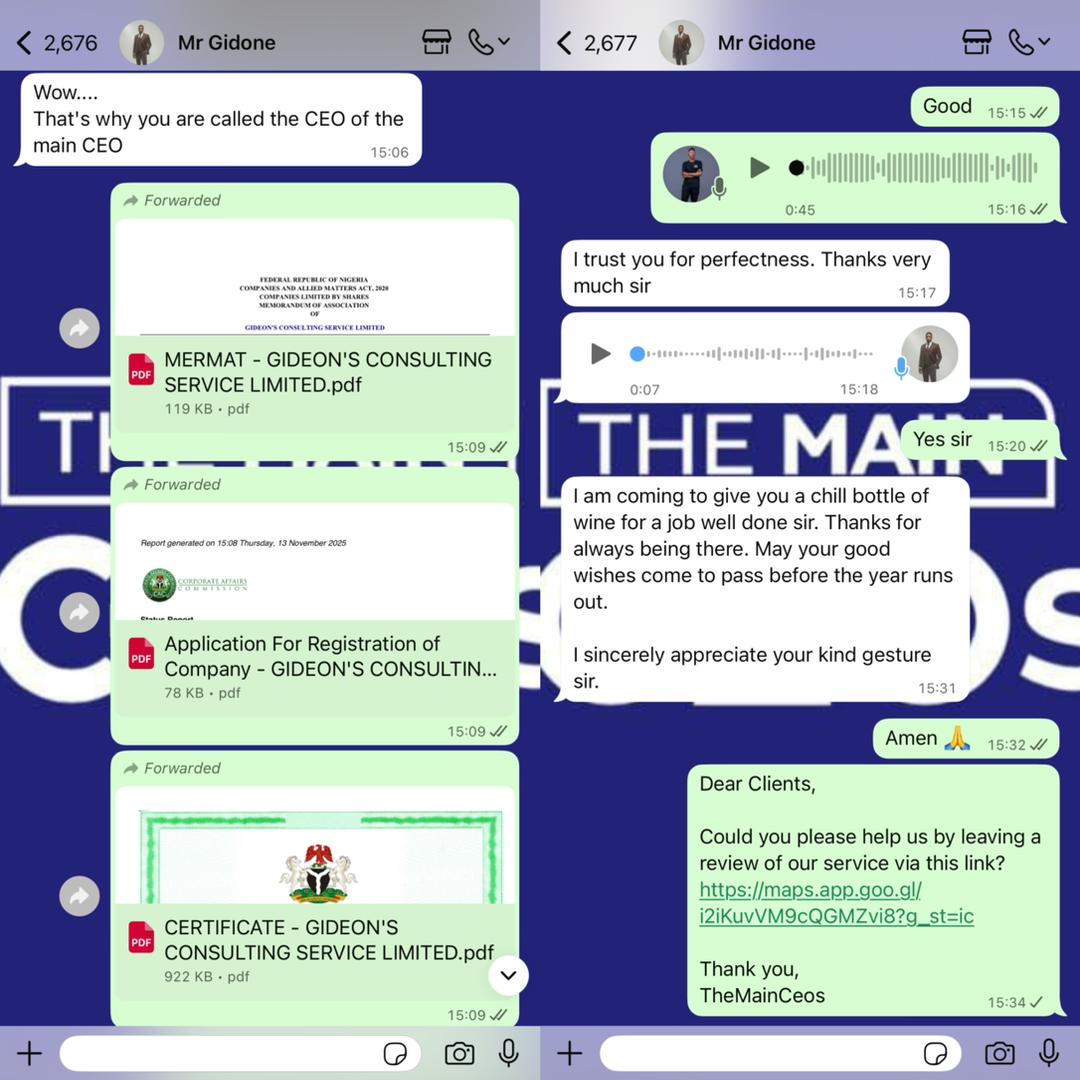

Real CAC documents (sensitive details blurred where needed) to show we don’t just talk — we deliver.

We don’t write laws — we help you structure your business so you can respond to them correctly.

Fill this quick form and send it straight to WhatsApp — we’ll guide you from there.

A few quick answers before you move forward.

It is shared as being effective from 1 January 2026. Always confirm the final official text and start dates from government/authorised channels before making binding decisions.

The JTB TIN is a unified identifier used across tax authorities, while the FIRS TIN is used at the federal level. In practice, issuance can be quite fast when portals are working — often around 48 hours, but always subject to system uptime and queue.

Typical timelines are around 7–14 days, but it depends on the queue. SCUML is often required for DNFBPs such as real estate, dealers in precious metals/jewellery, some consultants and NGOs — especially where banks request it for AML compliance.

Enterprise: owner = business, basic credibility, personal liability, better for

micro/small hustle.

LTD: separate legal entity, stronger credibility, better protection, better for

contracts, funding and tax alignment with company incentives.

Yes. This typically includes name reservation, constitution/minutes drafting, trustees’ declaration, two newspaper publications, CAC filing, certificate/status report and basic governance guidance.

Yes. We help with planning and optimisation for Meta, TikTok, Google, LinkedIn and more — plus social media management with content calendar, posting, engagement and analytics. Training is available on our learning platforms.

NYSC-focused packages and offers are available on nysc.themainceos.com, while broader courses and mentorship can be accessed on learning.themainceos.com.

Disclaimer: This page is an educational guide based on a curated summary of proposed/communicated changes (including PIT bands and business reliefs as shared). It is not formal tax advice and may not reflect the final, official wording of any law or regulation. Always confirm details with authorised government publications or a qualified tax adviser before making decisions. TheMainCEOs focuses on business registration, structure and basic compliance setup, not on issuing professional tax opinions.

Compare listings

ComparePlease enter your username or email address. You will receive a link to create a new password via email.